The Main Principles Of Custom Private Equity Asset Managers

(PE): investing in companies that are not publicly traded. About $11 (https://www.directorytogoto.com/articles/revolutionizing-wealth-your-guide-to-custom-private-equity-in-texas). There may be a few points you don't understand regarding the sector.

Exclusive equity companies have an array of financial investment choices.

Since the very best gravitate toward the bigger offers, the center market is a significantly underserved market. There are extra sellers than there are highly experienced and well-positioned finance professionals with substantial purchaser networks and sources to manage a deal. The returns of private equity are usually seen after a couple of years.

Examine This Report about Custom Private Equity Asset Managers

Traveling below the radar of big international corporations, a number of these little business usually offer higher-quality client service and/or specific niche you could try these out product or services that are not being used by the huge conglomerates (https://anotepad.com/note/read/gtek6cnk). Such advantages attract the interest of exclusive equity companies, as they have the insights and savvy to exploit such possibilities and take the company to the next level

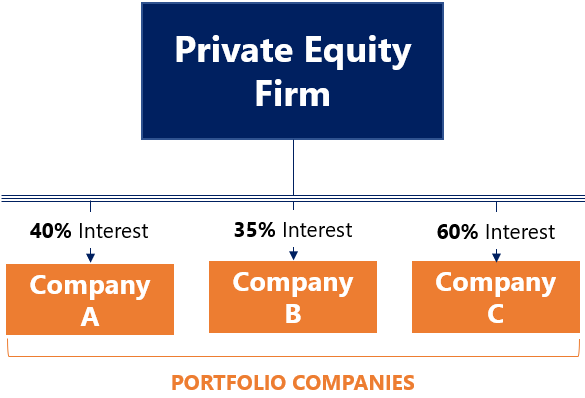

Personal equity capitalists have to have trusted, capable, and reputable administration in place. The majority of managers at portfolio firms are offered equity and benefit compensation structures that compensate them for striking their financial targets. Such positioning of goals is generally called for prior to a deal gets done. Private equity opportunities are frequently unreachable for people that can not spend millions of bucks, yet they shouldn't be.

There are policies, such as restrictions on the aggregate quantity of cash and on the number of non-accredited financiers (TX Trusted Private Equity Company).

6 Easy Facts About Custom Private Equity Asset Managers Shown

One more negative aspect is the absence of liquidity; as soon as in a private equity deal, it is not easy to get out of or sell. With funds under monitoring already in the trillions, personal equity companies have actually ended up being attractive investment cars for affluent individuals and establishments.

Currently that accessibility to personal equity is opening up to more specific capitalists, the untapped possibility is ending up being a fact. We'll start with the main arguments for spending in personal equity: How and why personal equity returns have historically been higher than various other properties on a number of levels, Exactly how consisting of private equity in a portfolio affects the risk-return account, by aiding to branch out versus market and intermittent danger, After that, we will certainly lay out some essential considerations and risks for personal equity capitalists.

When it pertains to presenting a new asset into a profile, one of the most standard factor to consider is the risk-return account of that property. Historically, personal equity has shown returns comparable to that of Arising Market Equities and greater than all various other standard asset classes. Its fairly low volatility coupled with its high returns makes for an engaging risk-return account.

The 7-Minute Rule for Custom Private Equity Asset Managers

Exclusive equity fund quartiles have the widest array of returns throughout all different asset courses - as you can see below. Technique: Interior price of return (IRR) spreads determined for funds within classic years individually and after that balanced out. Median IRR was calculated bytaking the average of the median IRR for funds within each vintage year.

The takeaway is that fund option is essential. At Moonfare, we execute a stringent selection and due persistance procedure for all funds listed on the system. The effect of adding personal equity right into a portfolio is - as constantly - based on the portfolio itself. Nevertheless, a Pantheon study from 2015 suggested that consisting of personal equity in a portfolio of pure public equity can open 3.

On the various other hand, the best private equity companies have accessibility to an also larger swimming pool of unidentified chances that do not encounter the same analysis, as well as the sources to do due diligence on them and identify which deserve buying (Private Asset Managers in Texas). Investing at the ground floor indicates greater risk, but also for the firms that do prosper, the fund gain from higher returns

The Custom Private Equity Asset Managers PDFs

Both public and private equity fund managers dedicate to spending a portion of the fund but there remains a well-trodden problem with aligning interests for public equity fund monitoring: the 'principal-agent trouble'. When a capitalist (the 'major') works with a public fund supervisor to take control of their funding (as an 'representative') they pass on control to the supervisor while preserving possession of the assets.

In the case of personal equity, the General Companion doesn't simply gain an administration cost. Personal equity funds additionally reduce one more kind of principal-agent issue.

A public equity financier inevitably wants one thing - for the administration to raise the stock price and/or pay rewards. The investor has little to no control over the decision. We showed above the amount of personal equity approaches - especially majority acquistions - take control of the operating of the business, guaranteeing that the long-lasting worth of the company comes first, pushing up the return on financial investment over the life of the fund.